City Council approved the tax rate bylaw on May 7, including a $5,239,440 tax revenue increase.

Municipal taxes will generate a total of $83 million for the City of Airdrie in 2024.

“Overall property values have increased, which means the tax rate has decreased as we are able to spread out the tax burden over more properties," said Monica Labait, Airdrie’s manager of revenue and assessment services.

The median single-family homeowner with a 13 per cent increase in assessed value from $496,800 to $556,000 will see an increase in municipal taxes of $12.25 per month, according to Labait. Property owners will experience changes based on any increased or decreased assessment value, she explained.

The majority of property owners will experience between a 10 to 12 per cent increase in overall property taxes.

“Even though the overall combined increase is 22.99 per cent of municipal and education, year over year growth has helped spread this burden over more properties so the effect is significantly less,” state City documents.

“A majority of the non-residential properties will see a decrease between four and six per cent in their property taxes if there is no change in assessed value.”

Due to higher inflationary increases to the residential assessment base, the tax burden has shifted even more from the non-residential to the residential base. Non-residential properties comprise about 13 per cent of the City’s total assessment value and generate 23.7 per cent of the municipal tax levy.

In Rocky View County (RVC), in order to mitigate some of this shift they have increased the ratio from 3:1 up to 3.5:1, said Labait. Meaning 3.5 times the residential rate is applied to the non-residential tax base.

“The City of Airdrie is maintaining the 2.1:1 ratio that has been in place for a number of years, which further enhances our competitive advantage to try to attract non-residential growth,” Labait said.

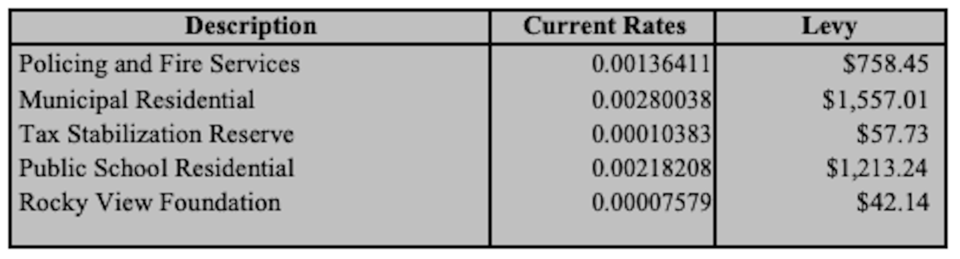

Of residential property taxes, 67 per cent are for municipal purposes, 32 per cent goes to the Province for education taxes and one per cent goes to the Rocky View Foundation.

This year, the Province increased the residential education tax by 18 per cent and the nonresidential amount by seven per cent in the City of Airdrie. Labait noted the effect of the education tax on the average household is an increase of $12.284 per month.

The Rocky View Foundation provides affordable housing options to seniors within Airdrie. Their requisition will be increasing from $675,508 to $1,301,976, an increase of $626,468 in 2024 to help fund services. The effect of this increase on the average household will be an additional $1.60/month.

As of Jan. 1, 2018, the Province assumed the responsibility for Designated Industrial Property assessment. The cost of assessing designated industrial property is recovered through a requisition and paid by designated industrial property taxpayers. The total revenue collected and remitted to the government in 2024 is $7,782.

Council approved the Community Revitalization Levy (CRL) in 2022, which went into effect Jan. 1, 2023. In 2023, the total funds raised by the CRL were $270,205, in 2024 they will be $483,827.

According to the City, as assessments increased the mill rate has decreased. The total change of the mill rate for residential properties is -2.56 per cent, while non-residential properties see a change of -4.41 per cent, state City documents.

The average home in Airdrie pays $758 towards protective services, $42 to the Rocky View Foundation, $58 to the tax stabilization reserve, $1,557 to municipal residential, and $1,213 to the education tax.

Once the tax rates are finalized, the tax department issues property tax notices. Property taxes are calculated by multiplying the 2024 property assessment by the tax rate.

The City of Airdrie previously did not communicate the municipal tax increase as a percentage, stating the percentage was misleading.

Airdrie’s 2024 proposed budget in early November 2023 included a proposed tax increase of 9.7 per cent, while later that month, the budget was approved including a tax increase of $5.2 million over 2023, with an impact of $146.91 annually for the average household.

Refer to airdrie.ca for taxation information or payment options.